Or sign in with

Content

The formulas for depreciation and amortization are different because of the use of salvage value. The depreciable base of a tangible asset is reduced by the salvage value. The amortization base of an intangible asset is not reduced by the salvage value. This is often because intangible assets do not have a salvage, while physical goods (i.e. old cars can be sold for scrap, outdated buildings can still be occupied) may have residual value. By definition, depreciation is only applicable to physical, tangible assets subject to having their costs allocated over their useful lives.

Writing off the entire copyright’s amount in 5 years over 5 equal instalments. Suppose a company Unreal Pvt Ltd. develops new software, gets copyright for 10,000, and it is expected to last for 5 years. The purchaser of a government license receives the right to engage in regulated business activities. For example, government licenses are required to broadcast on specific frequencies and to transport certain materials. The cost of government licenses is amortizable in the same way as franchise licenses.

Determining the capitalized cost of an intangible asset (the numerator in this equation) can be the trickiest part of the calculation. Let’s assume that a company has taken up a business loan of $5M for business expansion. The value ‘P’ represents the period in months when you repay the loan. The above figures are a little daunting if you look at them as is, so here is an example to demonstrate it. This is mainly used to calculate the amortization schedule of a loan. There is a mathematical formula to calculate amortization in accounting to add to the projected expenses.

Both terminologies spread the cost of an asset over its useful life, and a company doesn’t gain any financial advantage through one as opposed to the other. Amortization and depreciation are the two main methods of calculating the value of these assets, with the key difference between the two methods involving the type of asset being expensed. In addition, there are differences in the methods allowed, components of the calculations, and how they are presented on financial statements.

There was no premium or discount to amortize, so there is no application of the effective-interest method in this example. Multiply the $100,000 by the 5% interest rate and $5,000 is the amount of interest you owe for year 1. Subtract the interest from the payment of $23,097.48 to find $18,097.48 is applied toward the principal ($100,000), leaving $81,902.52 as the ending balance.

Our experts love this top pick, which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee. Goodwill is the portion of a business’ value not attributable to other assets. Goodwill is a common result of acquisitions where law firm bookkeeping the purchase price is greater than the fair market value of the assets and liabilities. Goodwill, for example, is an intangible asset that should never be amortized. Figure 13.7 shows an amortization table for this $10,000 loan, over five years at 12% annual interest.

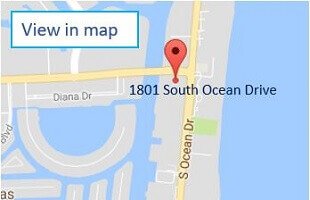

1801 South Ocean Drive, Suite C Hallandale Beach, FL 33009

1801 South Ocean Drive, Suite C Hallandale Beach, FL 33009

ДЛЯ БОЛЬШЕЙ ИНФОРМАЦИИ ЗВОНИТЕ НАМ

(786) 797.0441 or or: 305 984 5805